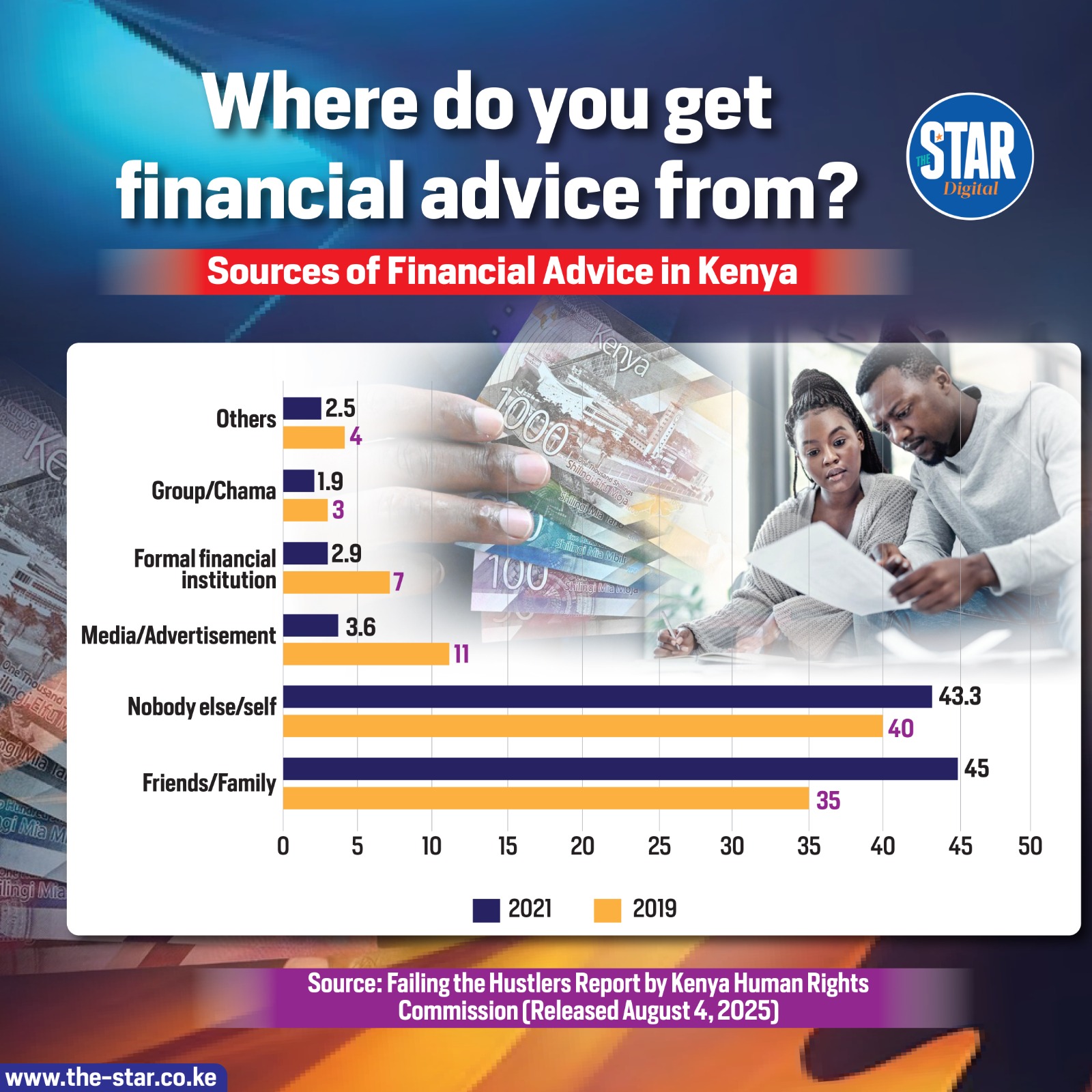

In a rapidly changing financial landscape, one of the most important questions for any economy—especially one with a growing middle class and increasing digital access—is: Where do people get their financial advice from?

According to a recent report by the Kenya Human Rights Commission (KHRC) released on August 4, 2025, most Kenyans continue to rely on informal networks for financial guidance. This includes friends, family, and—more increasingly—themselves. The data reveals a notable shift in where financial trust is being placed, with implications for both the formal banking sector and fintech innovators.

Key Insights from the Report:

-

In 2021, 45% of Kenyans sought financial advice from friends and family, up from 35% in 2019.

-

Self-reliance also grew slightly: 43.3% depended on their own understanding of money matters, compared to 40% in 2019.

-

The number of Kenyans consulting formal financial institutions dropped significantly—from 7% in 2019 to just 2.9% in 2021.

-

Other sources, including media, advertisements, and investment groups (chamas), remain marginal and continue to decline in influence.

What Does This Mean for the Financial Sector?

This data points to a crisis of trust in traditional financial systems. When fewer people turn to banks, SACCOs, or licensed financial advisors, it raises questions about accessibility, affordability, and perceived relevance of institutional financial products.

Kenyans may be leaning on friends and family because they feel:

-

Overwhelmed by technical jargon

-

Mistrustful of fees and hidden charges

-

Or simply unseen and underserved by existing financial services

This is also a wake-up call for fintech platforms, microfinance institutions, and digital banks to rethink how they build relationships with users. It’s not just about offering financial services—it’s about building trust, simplifying language, and proving value.

Opportunities for Businesses and Educators

For businesses operating in financial services, the shift highlights two main opportunities:

-

Financial Literacy Programs:

There is a growing appetite for people to manage their own money, but a gap in knowledge. Companies that provide user-friendly content, workshops, or tools for budgeting, investing, or credit management can tap into a large, underserved market. -

Social-Driven Product Development:

If Kenyans are turning to their peers for advice, then word-of-mouth and community endorsement are powerful marketing tools. Businesses should focus on building community-based referral models and integrating customer testimonials into their branding.

Trust is the New Currency

The KHRC data makes one thing clear: financial advice in Kenya is deeply personal and community-driven. As the economy grows and digitization accelerates, there is room for new players—especially those that understand the importance of human connection, trust, and clear communication in financial decision-making.

The future belongs to businesses that can combine technology with empathy, services with education, and advice with authenticity.