Unlocking Wealth: The Power of Dollar-Cost Averaging In Bitcoin Investment

As the world’s first decentralized digital currency, Bitcoin has sparked widespread interest and debate, with its meteoric rise in value and volatility making headlines around the globe. There are different strategies of Bitcoin investing, such as dollar-cost averaging that can help investors navigate the turbulent waters of cryptocurrency markets.

Timing is also very crucial in investment decisions, but achieving precision in this area poses significant challenges. An investment strategy that has proven effective, especially in managing volatility, is dollar-cost averaging (DCA).

DCA involves consistently purchasing a fixed dollar amount of an asset over time. This strategy aims to reduce the impact of market fluctuations by spreading out purchases. It is particularly attractive for assets with significant volatility, such as Bitcoin (BTC).

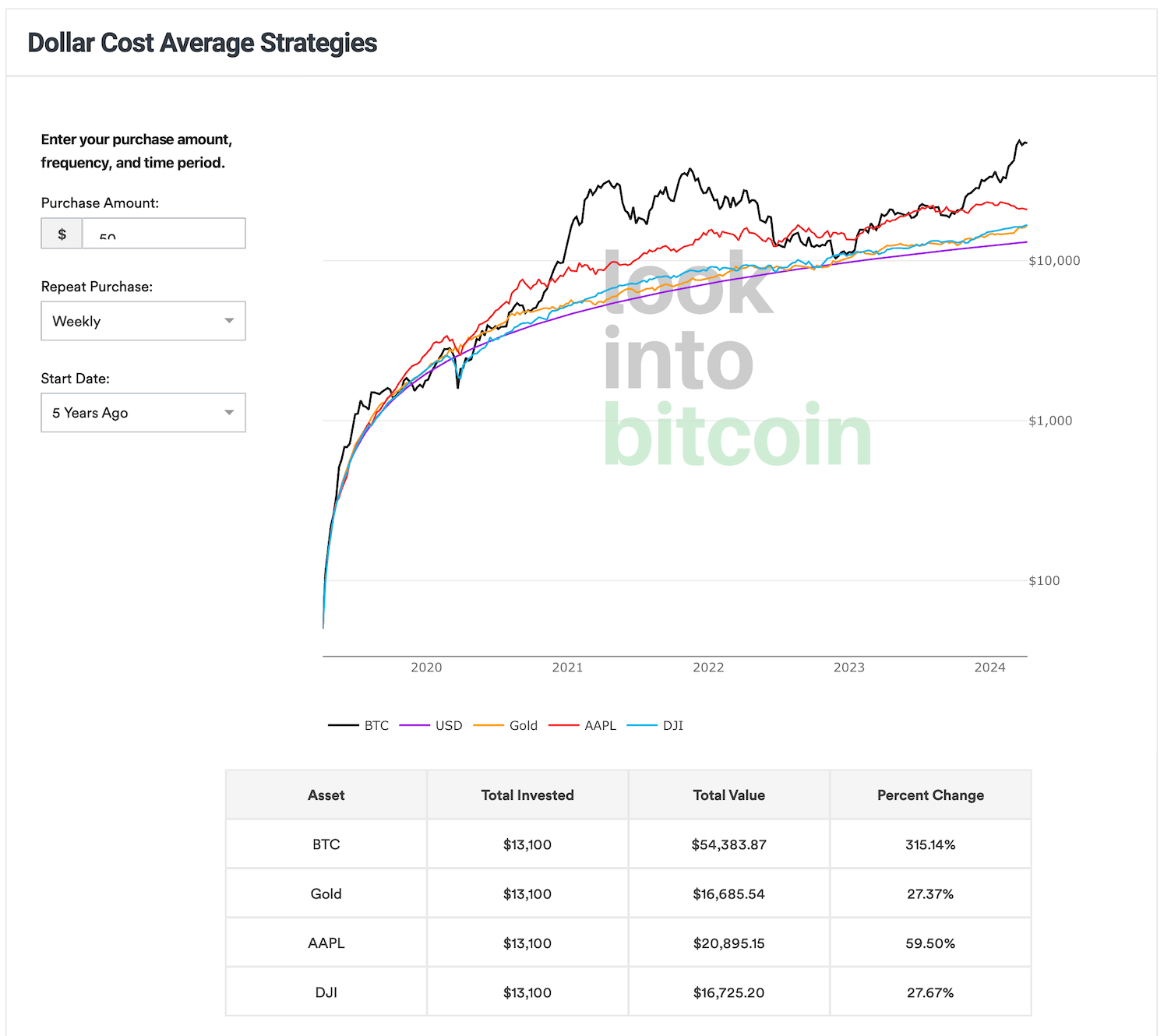

Investing $50 weekly, or $200 monthly, in Bitcoin since July 2019 would have yielded substantial returns, reaching 345.9% by January 2024. Despite an initial investment of just over $13,000, the total value would have soared to $58,193.

In comparison, investing in gold during the same period would have resulted in a modest return of 24.9%, while the Dow Jones Industrial Average (DJI) generated less than 1% more than gold.

However, it’s essential to acknowledge that Bitcoin’s volatility has been significantly higher compared to traditional assets. For instance, between 2020 and 2021, Bitcoin’s closing price surged to $46,387 by December 31, 2021, marking an astonishing 543.1% increase.

Yet, this meteoric rise was followed by a sharp decline of over 65% from November 2021 to November 2022, highlighting the extreme fluctuations inherent in the cryptocurrency market.

The unpredictable nature of Bitcoin’s price recovery, combined with its inherent volatility, may have made it challenging for investors to maintain their positions during this period. While DCA can be effective, it requires investors’ conviction in the chosen asset.

Dollar-cost averaging might be particularly suitable for new investors seeking to diversify their portfolios and navigate the volatile crypto landscape.

By investing a fixed amount regularly, regardless of market conditions, investors can spread out their purchases over time, mitigating the impact of short-term price fluctuations and volatility.

This strategy enables investors to benefit from the long-term growth potential of the asset. According to Daniel Masters, chairman at CoinShares, “With levels of annualized volatility implied at 75% or so, we know the price path of BTC will see many short-term highs and lows. Dollar-cost averaging is a stress-free way to accumulate a position reflecting a range of short-term market conditions, including cheap and expensive, and avoiding too much risk concentration at a single moment in time.”

For new investors entering the investment arena, DCA offers a straightforward and simplified approach. Instead of attempting to time the market and make large lump-sum investments, which can be daunting and risky, DCA allows investors to steadily build their positions over time.

The optimal BTC investing strategy largely depends on the investor’s risk tolerance, yet DCA might be a prudent approach to accumulating BTC during the next bull market.