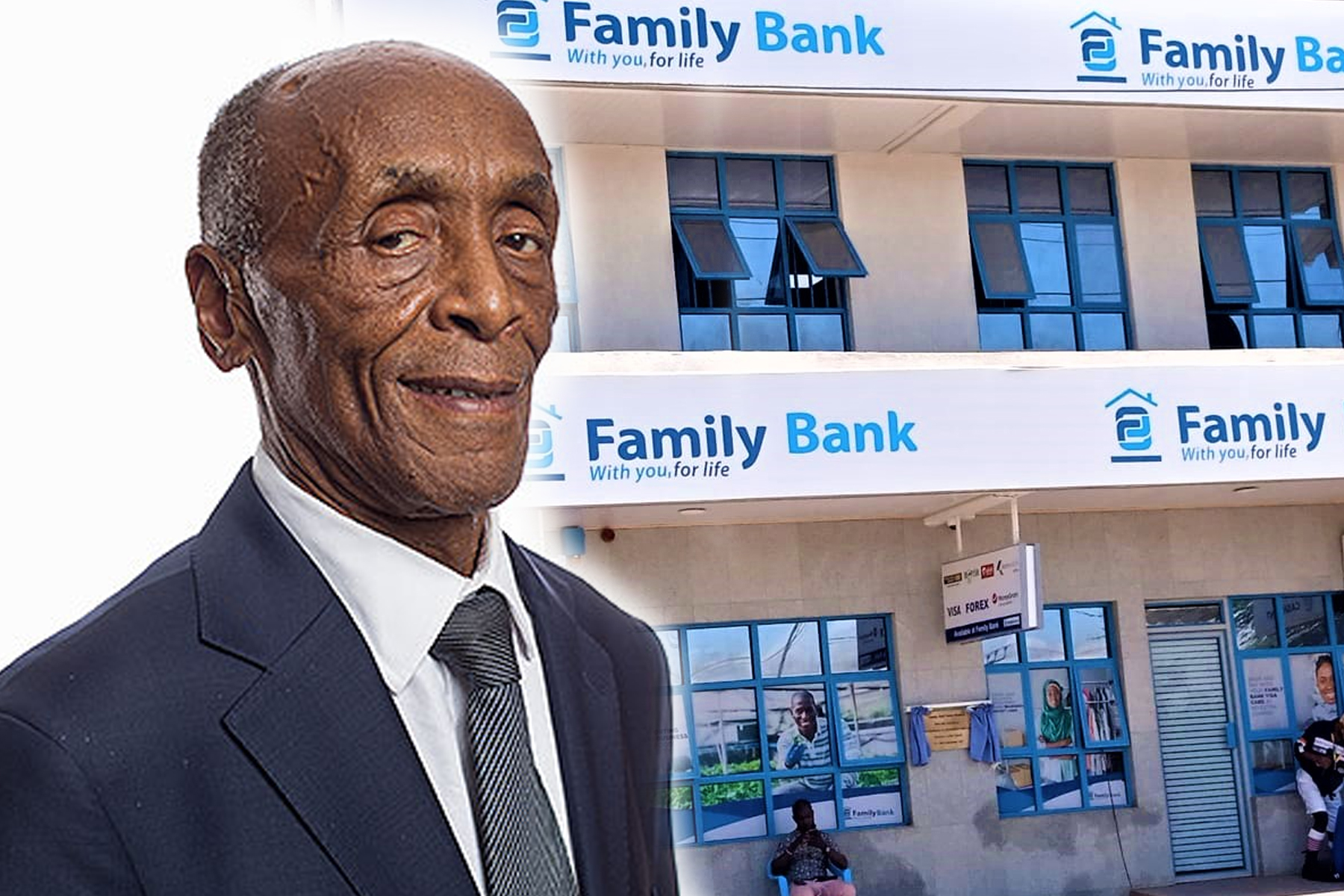

Muya Started His Own Bank After Being Denied Promotion For Lack Of Degree

The bank's creation has resulted in employment for more than 1,500 individuals since its inception.

With an asset base of Ksh 130 million, Family Bank has established itself as the top bank in Kenya after years of growth. The bank’s creation has resulted in employment for more than 1,500 individuals since its inception.

But the huge success story comes from one of the lowest points of Titus Kiyondo Muya, the bank’s founder.

Muya has multiple family-owned businesses across various industries including banking, insurance, real estate, and agriculture, and is recognized as one of the most exceptional entrepreneurs in the country.

He started the bank in 1984 after being denied a promotion at his bank job because he didn’t have a degree.

“Most of the big institutions we all see in the world today were all started by individuals. They all start small and in their own countries of origin and thereafter open branches across the world and become international organizations,’ said Muya.

‘Even some of the biggest banks you see in the world today were also started by individuals. They all start small and in their own countries of origin, and thereafter open branches across the world and become international organizations.’

The dream of founding a bank was born after reading a business article in an international magazine in 1961 at the age of 18. The verse in the magazine which inspired him the most and even changed his life read.

“I did not go to anybody’s University. And once in a while, I tell people I went to the University of Family bank because this is where I have learned so much,’’ he said.

His roles involved training University graduates who later became better than him, denying him promotions.

“When I asked my boss why I was not being promoted, I was advised I was not a University graduate. I was told since I was not a university graduate, promotions coming to me in the future would be few and far between,’ he said.

Having lost his father after his beaten to death by British colonizers and his mother was tortured badly to the point where she lost her sanity, Muya knew he had to step up.

As the eldest sibling, he felt it was his duty to provide for his younger siblings, and he believed that starting a bank would be the best way to accomplish this. Despite having no capital, Muya was fueled by his vision, determination, and idea to establish a bank.

He registered the bank in 1977 under the name Family Finance and Credit Limited which remained an idea for three years because of lack of capital.

He then applied for a banking license. His application was turned down by the National treasury because he did not meet the required criteria. The National Treasury advised him to apply for a building license instead.

He shared his disappointments with his friends, who encouraged him to apply for the building society license. He agreed, and the license was issued within two weeks. Family Finance and Credit Limited were then registered as a building society by the name Family Finance Building Society. Muya became the Chief Executive Officer of the.

The company expanded rapidly, opening three additional branches in Kiambu, Githunguri, and Nairobi within a year. Subsequently, the group introduced a school fees loan product aimed at assisting small-scale tea, coffee, and dairy farmers.

The product attracted a lot of customers, and within two years, the number of Family bank customers had grown in folds. All the branches in Nairobi and Kiambu counties started making profits, and the company expanded to other counties. By 2005, the Family Finance Building Society had over 30 branches countrywide.